TAX DECLARATION SERVICE

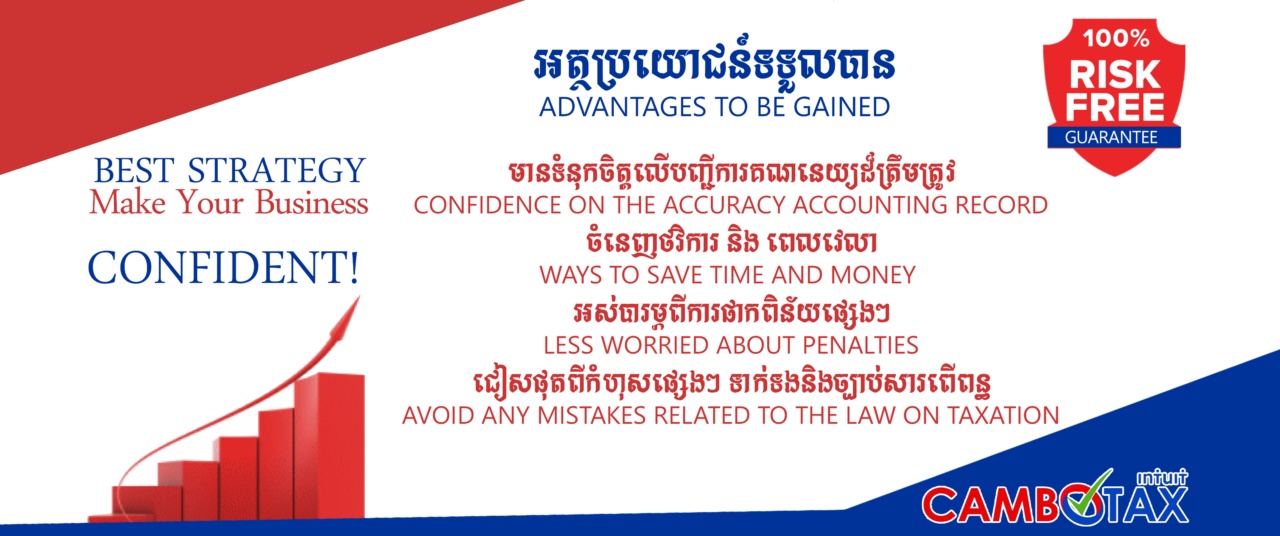

Tax Declaration Service in Cambodia is provided by Cambotax a forward thinking and reliable company will make your tax process easy. Calculating your income taxes can be one of the most complicated things that you need to do as a business owner. Often time there is more than one method of preparing a tax return or taking certain deduction, we are committed to evaluating each method and selecting the most beneficial one for our clients.

All businesses need to pay taxes based on the tax law of Cambodia such as:

Monthly Tax Return

- Return on salary tax (Article 53 of the law on taxation in the Kingdom of Cambodia)

- Return on prepaid profit tax (Article 104 new of the law on taxation in the Kingdom of Cambodia)

- Return on withholding tax (Article 25 new, 26 new, 31 new of the law on taxation in the Kingdom of Cambodia)

- Return on value added tax (Referred from VAT leaflet No.03 before completing the form)

Annual Profit Tax Return

(Article 29 of the law on taxation in the Kingdom of Cambodia)

- Legal form

- Depreciation schedule as per lot

- Tax on profit calculation schedule

- Balance sheet

- Income statement

- Cost of goods sold

- Cost of products sold

- Tax special depreciation schedule

- Provisions calculation schedule

Check Report

If the company already prepared, but it has not been smoothly acceptable, we would honestly redo it for you such as:

- Monthly tax return

- Annual profit tax return

Company Formation

We provide and supported in dealing with the legal and practical requirement for establishing new business in the Kingdom of Cambodia, including:

- Investment company register with Council for the Development of Cambodia (CDC)

- Non-investment company register with Ministry of Commerce (MOC)

- Simplified regime with Department of Commerce (DOC)

Tax Advisory

We provide a full range of advisory related to law on taxation from corporate tax and tax strategies to monthly tax return and annual tax return. The list below of deals and assignments in tax and advisory demonstrates our experts. It is the kind of tax that all of companies have to abide by law on taxation. There are many special taxes such as:

At Cambotax We are focused on helping small and medium size companies grow and reach greater profitability. Our commitment has been to put the clients needs before our own and it has served our team well.

Website

HEAD OFFICE

Address: #279E0E1, St 89, Sangkat Russey Keo, Khan Russey Keo, Phnom Penh, Cambodia.

H/P: +855 16 809080 (Smart), WhatsApp, WeChart, Line, Viber

H/P: +855 61 809080 (cellcard) Telegram

Tel: +855 67 809080 (metfone)

Tel: +855 92 779 889 (cellcard) ,

Email: cambotax@gmail.com, info@cambotax.com

Website: http://www.cambotax.com