HOW TO PAY TAX IN CAMBODIA

"How to Pay tax in Cambodia", is kind of complicated and frustrated without any knowledge of rules and regulations on how to do it within this country. when doing business in Cambodia, Business owners need to follow the law of Cambodia and they also need to use their rights properly and fulfill their obligations which is paying tax. They might end up in seriously fine by the General Department of Taxation, business closure or at an extreme case they will be charged with penal offend for not paying tax.

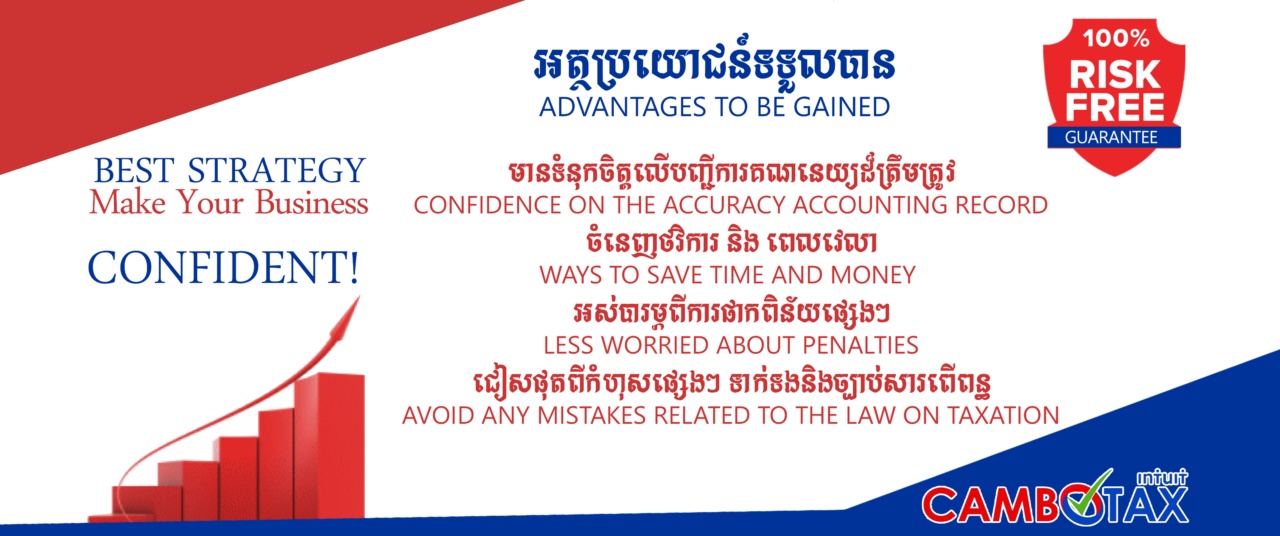

At Cambotax, We can deal with these issues. Business owners can now contact us through our email address and phone number. we will pleasure to consult with you related to tax process, tax registration, business registration and other kinds of commerce law related stuffs.

we are looking forward to server you with our forward-thinking and reliable services.

Below are the obligations and rights of the taxpayers.

| OBLIGATIONS AND RIGHTS OF TAXPAYERS | ||

| Obligations of Taxpayers | ||

| - | Register with the tax administration | |

| - | File tax returns and provide information as required by the tax provisions | |

| - | Pay taxes by the due date | |

| - | Keep and maintain books of account, legal documents, and other documents and present them to the tax administration | |

| - | Present to the tax administration according to the date specified in the letter of notification of the tax administration | |

| - | Pay taxes, additional taxes, and interest as determined by the tax administration by the date as stated in the tax provisions or as notified in writing by the tax administration | |

| - | Be truthful in fulfilling tax obligations | |

| - | Be cooperative with the tax administration in order to meet tax obligations | |

| Rights of Taxpayers | ||

| - | Have information provided to the tax administration treated as confidential | |

| - | Be offered professional service and assistance to help understand tax system and procedures and fulfill tax obligations | |

| - | Obtain explanation of the decisions made by the tax administration about tax affairs | |

| - | Make a complaint about decisions made by the tax administration | |

| - | Pay no more tax than what is required by tax provisions | |

| - | Have the authorized representative of their choice accepted in offering advice about tax affairs | |

| - | Be treated fairly and reasonably by the tax administration | |

| - | Be treated as being honest in fulfilling tax obligations | |

From team of Cambotax.

At Cambotax We are focused on helping small and medium size companies grow and reach greater profitability. Our commitment has been to put the clients needs before our own and it has served our team well.

HEAD OFFICE

Address: #279E0E1, St 89, Sangkat Russey Keo, Khan Russey Keo, Phnom Penh, Cambodia.

H/P: +855 16 809080 (Smart), WhatsApp, WeChart, Line, Viber

H/P: +855 61 809080 (cellcard) Telegram

Tel: +855 67 809080 (metfone)

Tel: +855 92 779 889 (cellcard) ,

Email: cambotax@gmail.com, info@cambotax.com

Website: http://www.cambotax.com